Find out how the rule of 42 can enhance your investment strategy. Diversify effectively by holding multiple asset types.

Finance

Finance. It is not hard to make money. Some people struggle with money management, but with the correct resources and information, anyone can build wealth that lasts for generations.

Here’s how finance (trading, investing, and wealth management) differs yet complements one another:

Trading focuses on buying and selling financial instruments like stocks, bonds, currencies, or derivatives on exchanges or over-the-counter markets. Traders aim to profit from short-term market movements and rely heavily on tools like technical analysis and market news.

Investing is about putting money into assets, such as equities, fixed income securities, real estate, or startups, with the goal of long-term growth or income. Investors often use strategies based on fundamental analysis and diversification to minimize risks and maximize returns over time.

Wealth management encompasses both investment management and financial planning, providing tailored advice on saving, investing, taxes, estate planning, retirement strategies, and preserving wealth. It’s typically designed for individuals or families with significant assets and complex financial situations.

Together, they cover different aspects of managing, growing, and preserving money.

Fear and Greed Indexes: CNN – FearGreedMeter – CoinMarketCap

Naked Options

Grasp the concept of naked options and their implications. Understand how they can offer high returns but come with great risks.

LEAPS

Explore the benefits of LEAPS as a strategic investment tool with longer expiration dates for capitalizing on market trends.

0DTE Options

Looking for action? Dive into 0DTE options trading. Uncover the benefits of quick profits and high volatility in this exciting market strategy..

Basics of The Greeks

Basic understanding of the Greeks in finance: key metrics that measure option price sensitivity and help traders manage risk effectively.

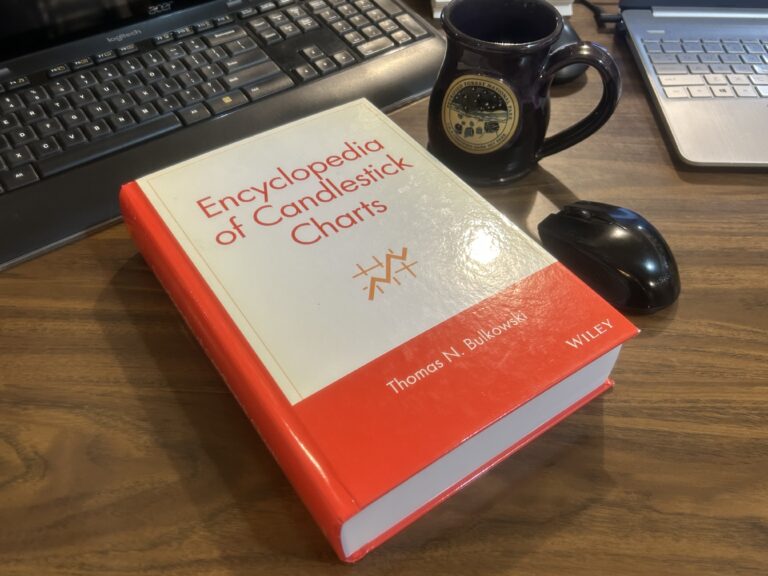

Encyclopedia of Candlestick Charts by Thomas N. Bulkowski

Recently added to my library, The Encyclopedia of Candlestick Charts by Thomas N. Bulkowski is a comprehensive guide to candlestick charting, a popular method used in technical analysis for trading.…

Rule of 40

What is the rule of 40? Uncover how this metric helps evaluate SaaS efficiency and profitability. Find out more inside.

Rule of 9

Understand the rule of 9 and its importance in bookkeeping for spotting transposition errors in numbers quickly.

Rule of 69

The Rule of 69 is a financial shortcut used to estimate how long it will take for an investment to double when interest is compounded continuously. It is similar to…