Fibonacci ratios are mathematical relationships derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (e.g., 0, 1, 1, 2, 3, 5, 8, 13, …). These ratios are widely used in technical analysis to identify potential support and resistance levels in financial markets.

Key Fibonacci Ratios

- Retracement Levels—Used to predict price pullbacks:

- 23.6% – Minor retracement.

- 38.2% – Moderate retracement.

- 50% Common retracement level.

- 61.8% – Strong retracement.

- 78.6% – Deep retracement.

- Extension Levels – Used to estimate price targets:

- 161.8% – Strong price extension.

- 261.8% – Aggressive price movement.

- 423.6% – Rare but powerful extension.

These ratios are derived from the mathematical relationships within the Fibonacci sequence. For example, dividing one number in the sequence by the next one gives 0.618 (or 61.8%), while dividing by the second number ahead gives 0.382 (or 38.2%).

How Fibonacci Ratios Are Used in Trading

- Fibonacci Retracements – Traders use Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8%) to predict where a price might pull back before continuing its trend. These levels help identify buying or selling opportunities.

- Fibonacci Extensions – These ratios (161.8%, 261.8%, 423.6%) help traders estimate how far a price might extend after a retracement, useful for setting profit targets.

- Support & Resistance Levels – Fibonacci ratios often align with key price levels where the market tends to reverse or consolidate.

- Trend Confirmation – When price movements respect Fibonacci levels, traders use them to confirm trends and adjust their strategies accordingly.

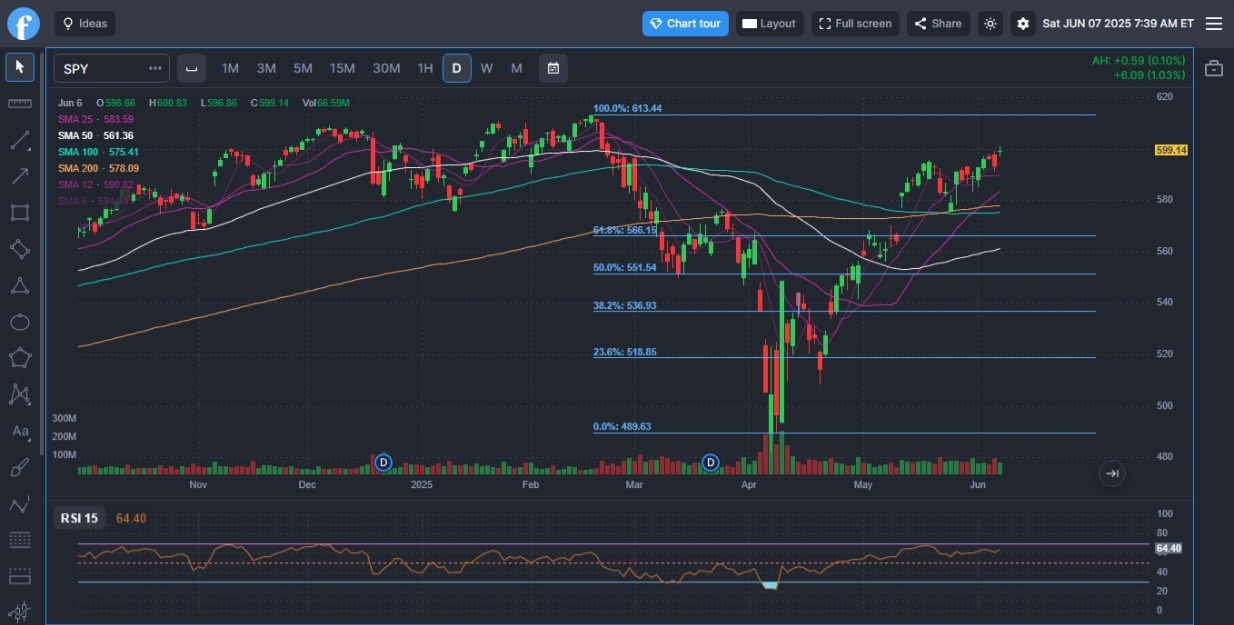

Applying Fibonacci Ratios in Charts

Traders typically use Fibonacci tools available on trading platforms to mark key levels based on recent highs and lows. Here’s how they do it:

- Identify a recent significant price swing (high to low for downtrends, low to high for uptrends).

- Apply Fibonacci retracement levels to predict where the price might reverse.

- Use extension levels to identify profit targets if the trend continues.

Fibonacci levels work best when combined with other technical tools like moving averages, trendlines, and candlestick patterns for confirmation.