Understand the rule of 73 for estimating investment growth and how long it takes for your investment to double.

Finance

Finance. It is not hard to make money. Some people struggle with money management, but with the correct resources and information, anyone can build wealth that lasts for generations.

Here’s how finance (trading, investing, and wealth management) differs yet complements one another:

Trading focuses on buying and selling financial instruments like stocks, bonds, currencies, or derivatives on exchanges or over-the-counter markets. Traders aim to profit from short-term market movements and rely heavily on tools like technical analysis and market news.

Investing is about putting money into assets, such as equities, fixed income securities, real estate, or startups, with the goal of long-term growth or income. Investors often use strategies based on fundamental analysis and diversification to minimize risks and maximize returns over time.

Wealth management encompasses both investment management and financial planning, providing tailored advice on saving, investing, taxes, estate planning, retirement strategies, and preserving wealth. It’s typically designed for individuals or families with significant assets and complex financial situations.

Together, they cover different aspects of managing, growing, and preserving money.

Fear and Greed Indexes: CNN – FearGreedMeter – CoinMarketCap

Rule of 70

Utilize the rule of 70 to quickly approximate when your investments will double and enhance your financial planning.

Rule of 72

Utilize the Rule of 72 for insightful investment decisions. Estimate how long it takes for your investment to double.

Pareto Principle

The Pareto principle (also known as the 80/20 rule, the law of the vital few and the principle of factor sparsity) states that for many outcomes, roughly 80% of consequences…

Dividend Kings 2025

Find out which companies are recognized as 2025 Dividend Kings for their remarkable 50-year streak of increasing dividend payouts.

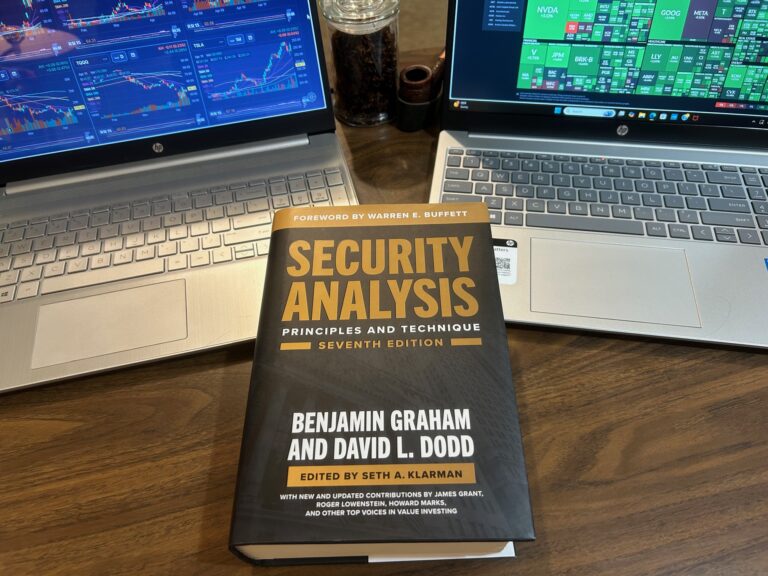

Security Analysis by Benjamin Graham and David L Dodd

Security Analysis by Benjamin Graham and David L. Dodd is a foundational text in the field of value investing. Published during the Great Depression, it emphasizes the importance of analyzing…

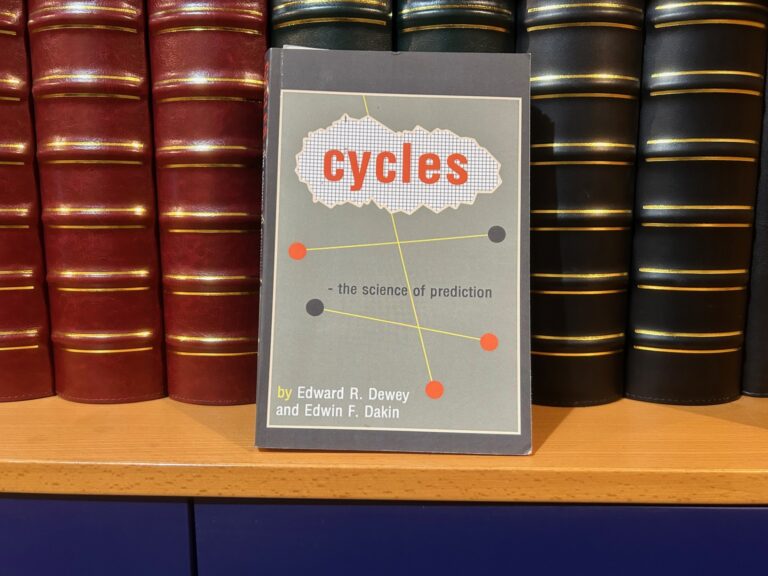

Cycles: by Edward R. Dewy and Edwin F. Dakin

Cycles by Edward R. Dewey and Edwin F. Dakin explores the concept of cyclic behavior in various fields, including economics, biology, sociology, and physical sciences. Dewey devoted his life to…

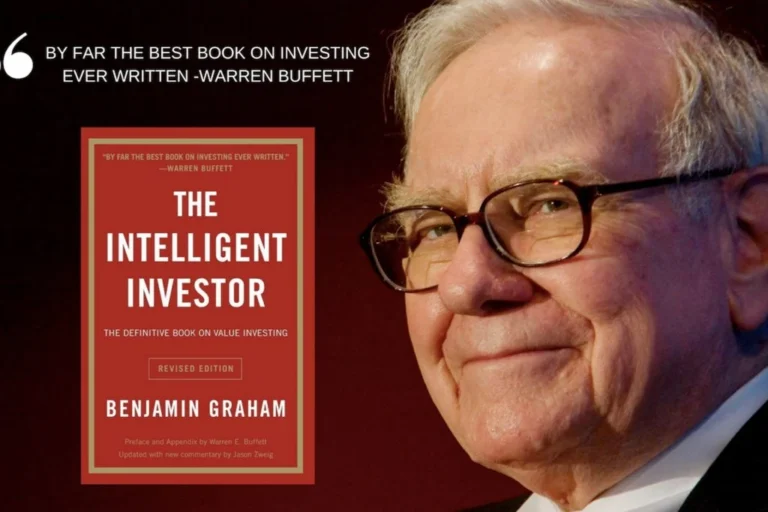

The Intelligent Investor by Benjamin Graham

The Intelligent Investor by Benjamin Graham is a classic guide to value investing, emphasizing the importance of a disciplined, long-term approach to building wealth. Graham distinguishes between investment and speculation,…

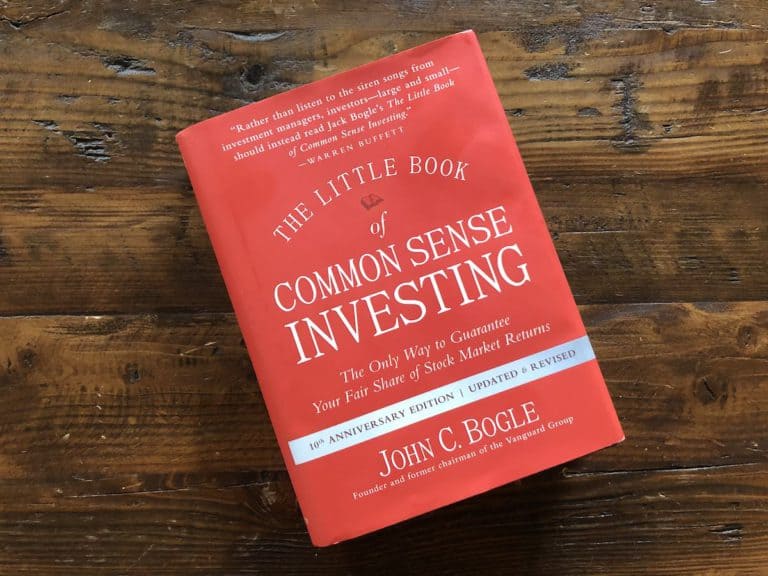

The Little Book of Common Sense Investing by John C. Bogle

The Little Book of Common Sense Investing by John C. Bogle emphasizes the importance of low-cost index funds as the most effective way to build wealth over time. Bogle, the…