W.D. Gann created Gann’s Theory, a trading method that combines time cycles, geometry, and mathematics to forecast market movement. Gann thought that by utilizing angles, cycles, and past patterns, natural laws could be utilized to forecast price changes.

Because extensive study is required for a complete understanding of how to utilize the strategy, what follows is provided to familiarize one with Gann’s Theory.

Principles of Gann’s Theory

- Gann Angles: These are diagonal lines used to identify support and resistance levels. The most famous is the 1×1 angle, which represents a perfect balance between time and price.

- Gann Angles are also known as the 45-degree angle.

- It signifies a sustainable trend—not too fast, not too slow.

- The 1×1 angle is often used to determine entry and exit points in a trade.

- Market Cycles: Gann observed that markets move in predictable cycles, often repeating at intervals like 90, 180, or 365 days

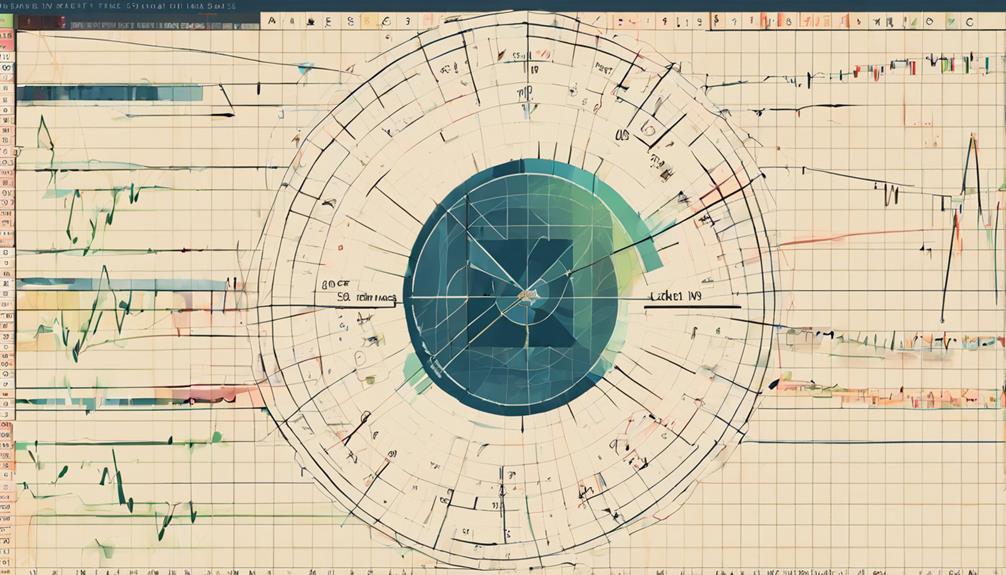

- Geometric Patterns: He used squares, circles, and hexagons to analyze price movements and forecast turning points

- Squares: Gann’s Square of 9 is one of his most famous tools. It helps traders identify key price levels based on mathematical calculations and time cycles. The square structure represents support and resistance zones and is used to forecast turning points

- Circles: Gann believed that markets move in cycles, and circles represent continuous price movement. He used circular patterns to analyze trend reversals and time-based cycles

- Hexagons: Hexagonal formations were used to track market phases, volatility, and trend reversals. These shapes reflect angular relationships in price movements, helping traders anticipate breakouts or stagnation

- Time and Price Equilibrium: Gann believed that price and time must be in balance for a trend to continue

- Historical Price Analysis: He studied past market movements to predict future trends, emphasizing that history repeats itself

Applying Gann’s Theory

- Traders use Gann Fans to identify trend reversals and price targets

- Gann’s Square of 9 helps determine key price levels based on mathematical calculations

Although Gann’s Theory is still widely used by technical analysts, mastering his trading philosophy requires extensive study and experience.